Development finance and trusted connectivity for sustainable development

Global Economy & Business

•

1h 0m

THE ROLE OF DEVELOPMENT FINANCE AND TRUSTED CONNECTIVITY IN ACHIEVING THE SUSTAINABLE DEVELOPMENT GOALS - The Atlantic Council’s Global China Hub and Scowcroft Center for Strategy and Security hosted a virtual public panel on the role of development finance and trusted connectivity in achieving the sustainable development goals (SDGs). This virtual event took place on Monday, October 18, 2021.

The United Nations (UN) has estimated that the funding gap for building the infrastructure in developing countries required for achieving the SDGs is over one trillion dollars annually. Official Development Assistance (ODA), even during the record year of 2020, amounted to only 161 billion dollars. As agreed in Addis Ababa Action agenda, there needs to be a global partnership for funding the SDGs that is able to mobilize private sector financing. Both the United States and Finland have answered the call. As you know, in the United States, the Build Act established the US International Development Finance Corporation (DFC) in 2020. DFC has a broad mandate to work with the private sector on project finance in developing countries and a commitment authority of sixty billion dollars that can be leveraged to that effect. In Finland, the balance sheet of DFC’s sister institution, Finnfund, has nearly doubled since 2015. In the multilateral context, both countries have been strong supporters of strengthening the IFC.

As highlighted by the World Development Report 2021 “Data for Better Lives,” digital connectivity and responsible data use is today essential for development. Digital solutions are driving services and more efficient production in both the public and private sectors. Data is important for driving these digital solutions, evidence based policy making and holding governments to account. At the same time data can also be used to limit freedom through excessive government and corporate surveillance. Data can also be used by large corporations to dominate and distort the market. Governments need to adopt policies and laws as well as implement them in such a way that the benefits are maximized and negative aspects prevented.

The panel discussed how development finance institutions like IFC, DFC and Finnfund can help mobilize private capital to bridge the infrastructure gap for achieving the SDGs, while at the same time making sure that the funding is supporting trusted connectivity and counteracting possible negative outcomes of the transition to a digital economy.

ORIGINAL AIRDATE: 10/18/21

Up Next in Global Economy & Business

-

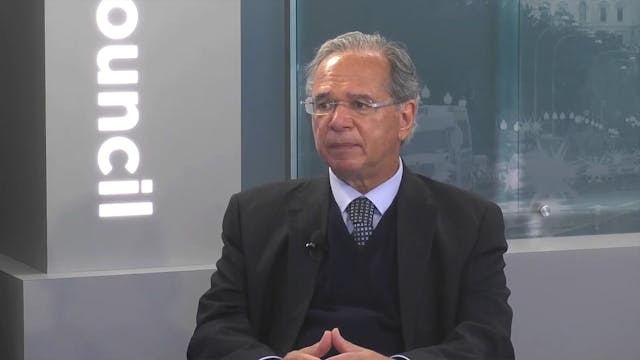

A conversation with Paulo Guedes, Bra...

BRAZIL'S ECONOMIC OUTLOOK: A CONVERSATION WITH H.E. PAULO GUEDES, BRAZIL’S MINISTER OF THE ECONOMY - Brazil’s Minister of the Economy, Paulo Guedes, took office in 2019 with a focus on further opening Brazil’s economy and carrying out a series of reforms to reduce the size of the government and e...

-

Director of the National Economic Cou...

A SPECIAL EVENT WITH BRIAN DEESE, DIRECTOR OF THE NATIONAL ECONOMIC COUNCIL - The Atlantic Council’s GeoEconomics Center hosted a special event with the Director of the National Economic Council, Brian Deese, on June 23, 2021.

As the United States confronts a series of challenges—the COVID-19 pa...

-

African economic recovery: The strate...

AFRICAN ECONOMIC RECOVERY: THE STRATEGY OF BOAD IN A POST-COVID-19 WORLD - While international development organizations stress African resilience, what is the The West African Development Bank’s (BOAD’s) role? Will the capital increase of the bank be strong enough to support an efficient strateg...