Missing key: The challenge of cybersecurity and central bank digital currency

Global Economy & Business

•

58m

MISSING KEY: THE CHALLENGE OF CYBERSECURITY AND CENTRAL BANK DIGITAL CURRENCY - With more than 100 countries exploring the issuance of central bank digital currencies (CBDCs), there is an urgent need to make responsible innovations in digital currency.

Security issues have multiplied with the rise of the Internet and the threat of cyberattacks. Many central banks, including the Federal Reserve, consider cybersecurity a top priority. CBDCs have quickly landed on the international policy landscape. It is therefore critical that policy makers understand the novel cybersecurity implications that could emerge from issuing a CBDC. Of the G20 economies, 19 are exploring a CBDC with the majority already in pilot or development. This raises immediate questions about cybersecurity and privacy. A government-issued digital currency system could, but does not necessarily need to, collect, centralize, and store massive amounts of individuals’ sensitive data, creating significant privacy concerns. It could also become a prime target for those seeking to destabilize a country’s financial system.

A new report from the GeoEconomics Center analyzes the intertwined questions of policy, design, and security to focus policy makers on how to build secure CBDCs that protect users’ data and maintain financial stability.

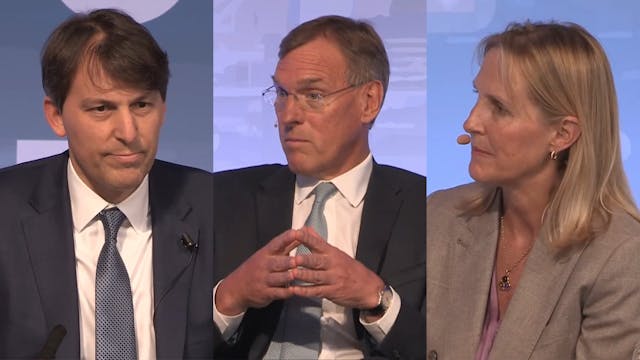

To launch the report, the GeoEconomics Center hosted on June 15 a panel discussion on the challenge of cybersecurity and CBDCs. Carole House, director of cybersecurity and secure digital innovation at the National Security Council offered opening remarks followed by a discussion with Neha Narula, director of MIT’s Digital Currency Initiative, Giulia Fanti, report co-author and nonresident senior fellow with the Atlantic Council GeoEconomics Center, and Michael Mosier, general counsel at Espresso Systems, senior advisor at Oliver Wyman, and former acting director of the U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN). Our speakers discussed key concepts, potential design trade-offs, and some policy principles to put forward a road map for policy makers of how to develop safe CBDCs. This discussion was moderated by Josh Lipsky, senior director of the GeoEconomics Center.

ORIGINAL AIRDATE: 06/15/22

Up Next in Global Economy & Business

-

War in Europe: Global supply chains a...

WAR IN EUROPE: GLOBAL SUPPLY CHAINS AND THE TRANSATLANTIC ECONOMY - Russia’s invasion of Ukraine has compounded supply chains and trade flows disruptions after the COVID pandemic. Sanctions and other restrictive measures may add fuel to the fire. Many countries, including the US and in Europe, ar...

-

The future of UK banking and finance

THE FUTURE OF UK BANKING AND FINANCE - The Atlantic Council GeoEconomics Center, in partnership with New Financial and Centre for Policy Studies—two leading UK think tanks—hosted "the future of UK banking and finance" conference on April 28th. The event marked the launch of new research on UK fin...

-

Akinwumi Adesina, President of the Af...

A CONVERSATION WITH AKINWUMI ADESINA, PRESIDENT OF THE AFRICAN DEVELOPMENT BANK - As part of the IMF and World Bank Group Spring Meetings taking place from April 18th to the 22nd, the Africa Center has convened the timely “2022 Spring Meeting Dialogues,” highlighting African views during the stra...